Government Bond Market – Global Overview and Lessons for Vietnam

On the international market, the investment in government bonds plays a crucial role in public debt management and macroeconomic regulation. Major economies such as the United States and China owe nearly 50% of the total global public debt.

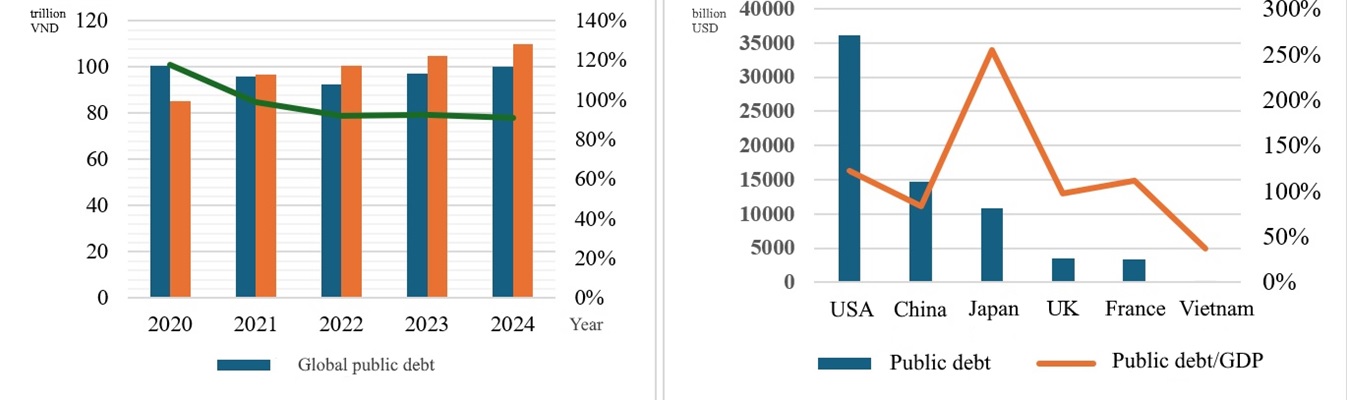

In 2024, as the U.S. tightened its monetary policy to combat persistently high inflation, government bond yields remained elevated in many major economies (except China) due to interdependencies among large economies. This has increased the debt service burden for developed nations, impacting global financial markets, as these countries have a relatively high public debt-to-GDP ratio compared to global averages (Figure 1). Global public debt showed a slight upward trend, maintaining a level close to global GDP between 2020 and 2024 (Figure 2).

According to government bond yield statistics for 2024, Japan and Switzerland had the lowest 10-year government bond yields (1.055% and 0.251% respectively, as of December 16). Meanwhile, among major economies, Australia, the United Kingdom, and the United States had the highest 10-year government bond yields (4.365%, 4.405% and 4.386% as of December 16).

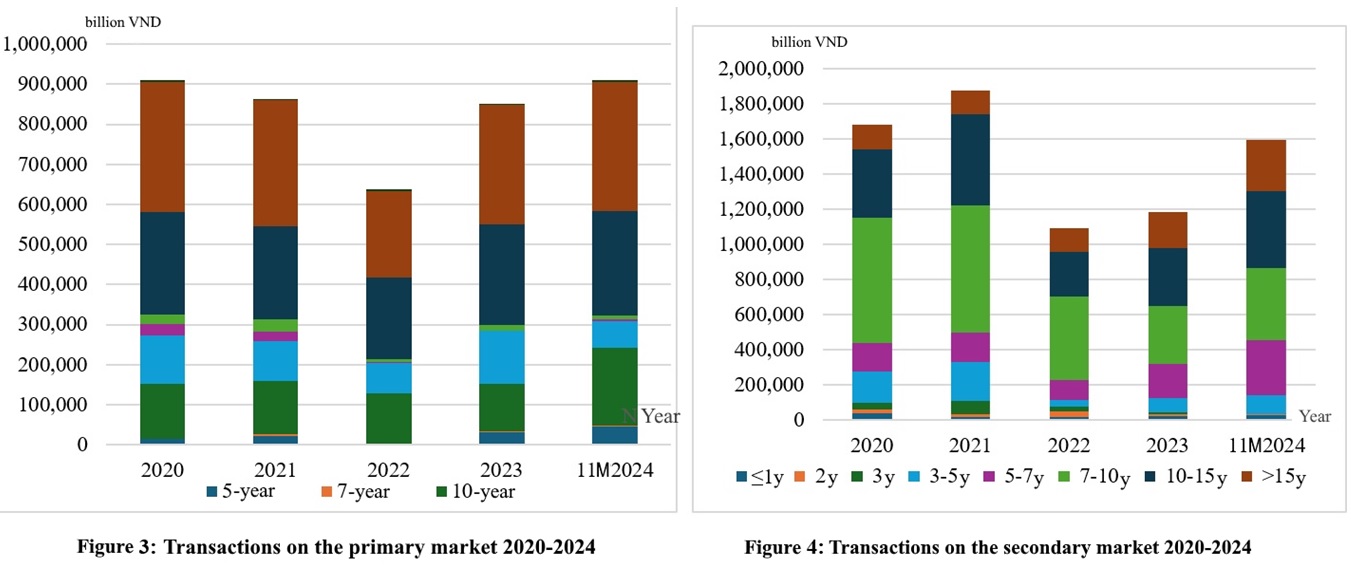

Investing in government bonds has become a crucial strategy in national financial management and global macroeconomic regulation. These bonds not only serve as an effective capital mobilization tool for governments but also help manage public debts and maintain financial stability. Major economies like the U.S. and China, possessing nearly 50% of global public debt, demonstrate the importance of government bond markets in mitigating macroeconomic risks. Especially amid tight monetary policies and high inflation pressures, government bond yields in developed countries such as the U.S., the UK, and Australia remain high, offering significant benefits to investors. This highlights the strategic role of government bonds in stabilizing financial systems, minimizing negative market fluctuations, and laying the foundation for sustainable economic development. Between 2019 and 2023, Vietnam’s government bond market witnessed significant changes. In the primary market, bond issuance volume sharply dropped in 2022 (a 31.5% decrease from 2021) due to the overall market downturn. However, in 2023, as the bond market recovered under the government’s support, primary market issuance surged by 40% year-over-year, continuing its upward trend into 2024. During this period, bond issuance shifted to focus increasingly on 10-year and 15-year tenures, accounting for approximately 75%–95% of total issuance in the primary market. Winning yields generally followed a downward trend to support economic growth (Figure 3).

In the secondary market, trading activity changed from short-term bonds (under five years) to longer maturities, partly due to the State Treasury halting the issuance of bonds with maturities under five years. Bonds with 7 to 15-year maturities accounted for 53%–67% of total secondary market transactions. Trading yields declined sharply during 2020 – 2021 period, rebounded in 2022, but then resumed their downward trend through the end of 2024 (Figure 4).

The domestic decline in government bond yields has eased the Government’s budgetary constraints but has placed pressure on investors like the DIV in meeting revenue targets.

DIV’s Government Bond Investment: Achievements and Challenges

Safe and Effective Investment Strategy

Since the Law on Deposit Insurance took effect on January 1, 2013, the DIV has identified government bond investment as a core strategy to preserve and grow temporarily idle funds. Over more than 11 years of implementation, government bonds have remained the primary investment channel, accounting for over 99% of the DIV’s total investments. The DIV prioritizes investments in both primary and secondary markets.

The DIV’s investment in government bonds in the primary markethave consistently accounted for a high proportion of DIV’s total investments in government bonds. During the 2020–2022 period, this represented approximately 72.6% of total government bond investments, equivalent to VND 38.61 trillion. Since 2023, the investment proportion in the primary market has reached 100%. The average winning yield has declined from 4.70% per annum in 2019 to 2.52% per annum in 2024, necessitating strategic flexibility and optimization to hit the targets of revenue, finance and salary.

Despite the DIV's primary focus on the primary market, it invested over VND 14.552 trillion in government bonds in the secondary market between 2020 and 2022, accounting for 27.4% of total bond investments. The proportion of secondary market investment remained stable, slightly increasing to around 30% in 2020 and 2021, with an average of 40 transactions per year. However, from late 2022 to the present, due to fluctuations in market interest rates, limited bond supply, and other market conditions, the DIV has not made any further secondary market investments.

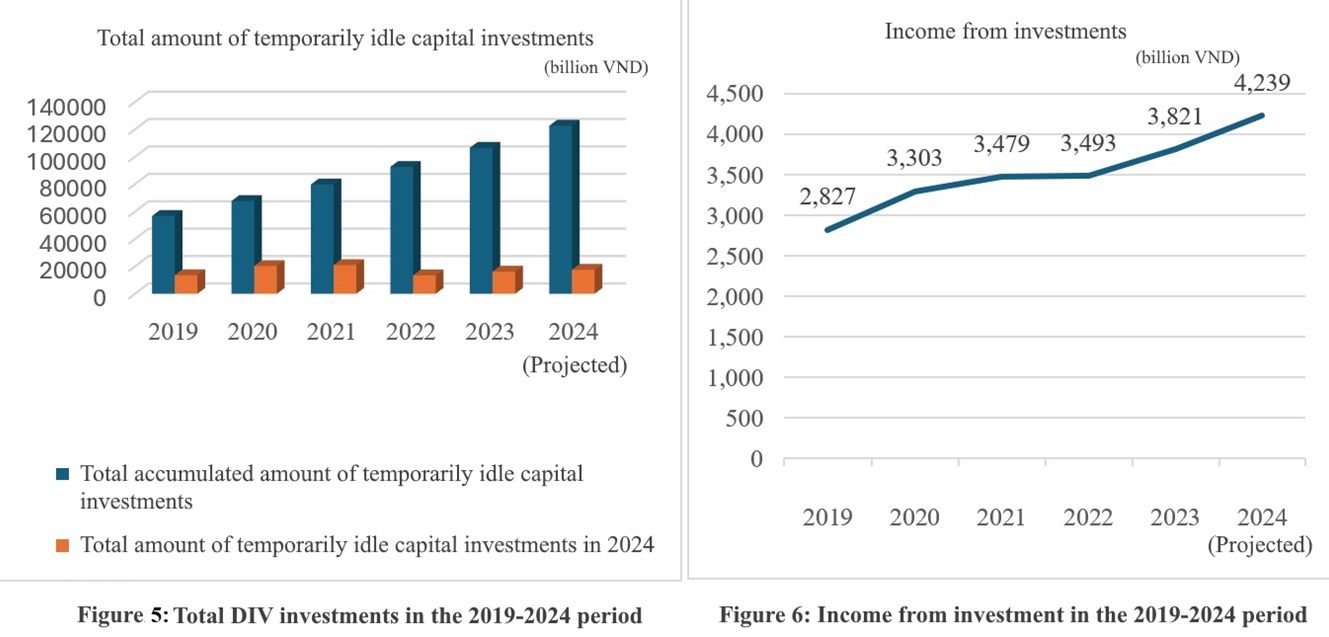

Thanks to a focused investment strategy and flexible market selection, the DIV’s cumulative total investment has grown significantly from an initial sponsored capital of VND 1 trillion to over VND 122.6 trillion by the end of 2024 with an average growth rate of nearly 16.7% from 2020 to 2024. Investment income has become the primary revenue source, constituting over 99% of the DIV’s total earnings. Interest income from investments increased from approximately VND 2.82 trillion in 2019 to nearly VND 4.24 trillion in 2024. With an average annual growth rate of 9.6% from 2019 to 2023, investment income helped the DIV accumulate capital, strengthen financial capacity, enhance its institutional position and ensure the successful implementation of public policy objectives related to deposit insurance (Figures 5 and 6).

Challenges in DIV’s Government Bond Investment

Government bond investment is considered a safe and stable source of annual income for the DIV. While positive results have been attained in recent years, several challenges remained including the misalignment between government bond auction schedules and the DIV’s idle cash flows, limiting the optimization of investment returns. Additionally, the downward trend in interest rates puts pressure on the accomplishment of revenue, financial, and salary targets. Furthermore, investment diversification is restricted, as current regulations do not permit investment in financial instruments other than government bonds and State Bank of Vietnam bills.

Strategic direction to enhance investment efficiency

The government bond market is expanding and being supported by new policies that provide the DIV with opportunities to refine its investment strategy and define its future direction. To enhance the efficiency of government bond investment aligning with the Development Strategic Plan for Deposit Insurance through 2025, with a vision towards 2030, the DIV should take the following measures:

- Development of a flexible mechanism: Propose policies that provide the DIV with greater flexibility in secondary market transactions.

- Specialized training: Strengthen the expertise of the DIV’s personnel through specialized training programs on government bond investment operations and risk management.

- IT enhancement: Promote the integration of information technology into investment management and analysis to optimize decision-making processes. Additionally, enhance risk-return analysis tools to assess profitability and risks across different investment portfolios, ensuring a balanced approach to long-term benefits and risks.

The DIV’s government bond investment not only contributes to capital stability but also enhances the organization’s position within the national financial safety net. With a clear strategic direction and support from new policies, the DIV is well-positioned to optimize investment efficiency, adapt to future market fluctuations, and continue asserting its role in Vietnam’s financial system.

Market Research Team – Department of Fund Management and Investment

Department of Research and International Cooperation (translation)