The latest research conducted by the International Association of Deposit Insurers (IADI) showed that during their development journeys, DIs have acquired significantly bigger roles and powers in the resolution of troubled credit institutions (CIs), especially since 2008. Resolution tools have also been more diversified.

Vietnam’s financial system is undergoing a restructuring of CIs. One of the core tasks of the restructuring for the period 2020-2025 is “focusing on steering the restructuring of troubled CIs by tools that suit the market mechanism while ensuring prudent principles, benefits of depositors, stability and safety of the CIs system”. (Party Committee of the State Bank of Vietnam, January 2021). In this context, the article analyzes changes in the roles and powers of DIs in resolution of troubled CIs and resolution tools over the world in the period 2014-2020, thereby sets forth some implications for Vietnam.

Role of DIs in resolution of troubled CIs

There is no standard model for DIs around the world to follow in their establishment and development process. When they were first established, some DIs started with a pay-box model, then gradually acquired additional tasks, some DIs were equipped with various tasks, powers and tools right from the beginning. Usually, multi-function DIs are located in countries with more developed financial systems. Besides, most of DIs established after the 2008 financial crisis were assigned with more comprehensive tasks (Defina, 2021).

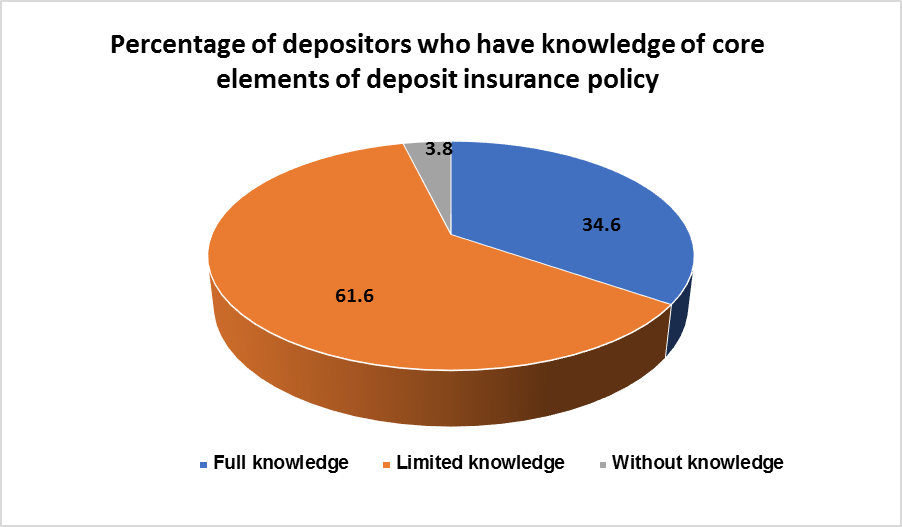

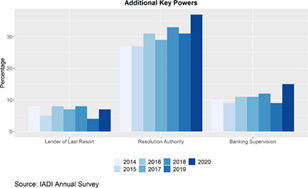

According the IADI’s survey in 2011, 38 percent of DIs in the world operate under pay-box model. By 2021, the figure dropped to 25 percent. For the period 2014-2020, there was no big change in the roles of DIs as lender-of-last-resort and supervisory agency. However, the role of failure resolution of DIs was remarkably strengthened with an increase of 30 percent.

Figure 1: Role of DIs in resolution of troubled financial institutions.

Changes in resolution tools

Resolution tools have undergone many changes for the last 10 years, especially after the 2008 crisis. This has been proved in 3 different ways: Annual survey of the IADI (2020), Cross-sectional study (Baudino et al., 2019); Quantitative research by time series method (IADI, Policy Brief no.3, August, 2021).

All three approaches came to a conclusion that failure resolution tools have significantly changed on a large scale in many countries in terms of resolution capacity to meet the requirements set by the 2008 crisis.

Specifically, the changes have focused on lessening the burden on taxpayers (FSB, 2014) such as CIs make provisions on losses in case of defaults in stead of receiving financial support from state budget. On selecting tools for resolution of systemic banks, it is advisable to consider several things such as cross-border issue, information sharing and crisis management.

Core Principle 12 of the Core Principles for Effective Deposit Insurance Systems (IADI, 2014) also recognizes bigger role of DIs over the world in failure resolution other than just pay-out function.

In the EU, Bank Recovery and Resolution Directive (BRRD) (2014) builds an overall coordination framework for EU member countries and the Single Resolution Board (SRB) in dealing with bank failures, which standardizes resolution tools used in EU countries. This Directive also highlights the application of the least cost test (LCT) and bail-in for loss sharing among bank equity-owners, creditors and DIs.

For the period 2014-2020, the set of resolution tools had remarkable developments. The liquidation and pay-out, open bank assistance were used rather stably without big changes.

On the other hand, 3 other tools including Purchase and Assumption (P&A), Bridge Bank (BB) and Bail-in were widely utilized by DIs in 2014-2020 stage. A survey conducted by IADI in 2020 revealed that P&A was applied by 75 percent of respondent DIs, against 60 percent 8 years previously.

Besides, Bridge Bank was used with a strong increase of 45 percent in 2014 up to 70 percent in 2020.

The Bail-in was noted as a resolution tool with an augmentation of 26 percent in 2016 to 40 percent in 2020.

The selection of tools for bank resolution depends on some certain factors, among which are the least-cost principle and systemic importance consideration. Without these two factors, DIs have some other common principles for choosing resolution methods. According to IADI’s 2020 annual survey, 64 percent of respondent DIs apply these principles in their resolution processes.

Therefore, on observing the fluctuation of the data in the survey, the types of resolution tool and conditions for choosing resolution tools by DIs have had some changes in recent years.

Lately, from the perspective of quantitative research by time series method, an IADI’s latest study (August, 2021) examined the change of DIs’ role in bank failure resolution and selection of resolution tools in the 2014-2020 period showed the following results:

Examination results on changes of troubled CIs resolution in the 2014-2020 period

|

Tasks/ Tools |

Observation Results |

|

Lender of last resort |

✖ |

|

Resolution of troubled CIs |

✔ |

|

Supervision |

✖ |

|

P&A |

✔ |

|

Open Bank Assistance |

✔ |

|

Bridge Bank |

✔ |

|

Liquidation |

✖ |

|

Payout |

✖ |

|

Bail-in |

✔ |

|

Least-cost test |

✔ |

|

Systemic importance consideration |

✔ |

Notes:

✔: tasks and tools were increased over time. This increase was statistical.

✖: there is no basis for a statistical increase in tasks and tools of resolution

The above table shows that for the period 2014-2020, the DIs’ role of bank failure resolution was increased over time and this increase was statistical. And so were the roles of the 4 tools including P&A, bridge bank, bail-in and open bank assistance. However, the role of liquidation and payout was not enhanced over time, while statistics proved that the least cost test and systemic importance consideration were strengthened.

Implications for Vietnam

Over the past 10 years, the role of DIs in handling weak CIs has been significantly enhanced. More diverse resolution tools, methods other than pay-out have been chosen by DIs around the world. Especially, bail-in was first used after the 2008 financial crisis for some CIs.

The Deposit Insurance of Vietnam (DIV) was established in 1999 – after the Asian financial crisis, with the initial core function of insured deposits payment, and some additional duties like supervision, financial assistance. Since the Law on Deposit Insurance and the amended Law on Credit Institutions took effect in 2013 and 2017 correspondingly, the tasks of DIV have been expanded in the direction of deeper participation in the restructuring of weak CIs. Thus, in the last 3 years, the role of DIV in dealing with troubled CIs has also been enhanced, following the general development trend of international DIs.

Regarding resolution tools, in addition to closing banks and paying depositors, merger, consolidation, and equity transfer, banking regulators in Vietnam also introduced a number of new tools including providing special loans to weak CIs and guarantees for bonds issued by assuming or assisting CIs (CIs that assist or participate in dealing with troubled CIs). Actually the DIV also participated in implementing these tools. Thus, in terms of resolution tools, Vietnam also follows the global trend of DIs adding new resolution tools other than pay-out. However, the bail-in has not been applied in Vietnam yet. This tool should be put into study and assessment for application so that resolution authorities could have more choices for resolution of banks in Vietnam.

Regarding conditions for selecting resolution tools, the least cost test and systemic importance consideration have not been clearly applied in Vietnam. This is contrary to the trend of deposit insurance systems in the world. Therefore, Vietnam should consider building clearer principles (especially the application of the least cost principle to small-scale CIs such as people's credit funds) as a basis for selecting appropriate tools, thus better contributing to the restructuring of CIs in the period of 2020 - 2025.

Pham Bao Khanh (PhD)

Standing Member of the DIV’s Board of Directors.

Translated by Research and international cooperation department

References:

The Party Committee of the State Bank of Vietnam (2021), Renovating and improving the efficiency of policy administration, Press Center of the XIII Congress

Baudino, P et al. (2019). Bank Failure Management – the role of Deposit Insurance, Financial Stability Institute Insights No.17

Defina, R. (2021). Banking Resolution, Expansion of the Resolution Toolkit and The Changing role of Deposit Insurers, Association of Deposit Insurers Policy Brief No.3

Defina, R. (2021). The Geographic Dynamics of Deposit Insurance, International Association of Deposit Insurers Policy Brief No.2

IADI (2020). Annual survey