Raising public awareness - perspective from international experience

As recommended by the International Association of Deposit Insurers (IADI), it is important to ensure the increasingly improved awareness and confidence of depositors in the deposit insurance and banking system, thereby strengthening the efficiency and effectiveness of the deposit insurance scheme, stabilizing the financial - banking system; effective communication campaigns should be conducted; the communication strategy should be periodically evaluated and surveys on the awareness of depositors should be conducted in order to update and supplement specific solutions for each period.

Besides, target communication objects and corresponding tools and solutions should be diversified and concretized; information technology, digital tools should be applied in the communication activities to the public in proceeding to build an online support system for depositors, using online tools such as email, online service on deposit insurance, social media, etc. in a reasonable and controlled manner.

In case there is a change in policy such as switching from blanket to limited insurance coverage, bank runs, failures of insured institutions, cross-border issues, etc., deposit insurers need to be cautious in their communication activities to ensure their prestige and trust of depositors; develop contingency plans, simulate potential situations to ensure that the public receives information in a timely manner, avoiding confusion.

Education and communication activities on deposit insurance policy and financial inclusion should be promoted in coordination with relevant agencies in the financial and banking sector, focusing on transparent and widespread disclosure of information, especially information on the protection of the legitimate rights and interests of depositors in special cases such as changes in coverage limits, during the handling of weak, failed and restructured credit institutions.

Regarding coordination and information sharing, there should be a clear mechanism for information sharing and coordination among members of the Financial Safety Net. The deposit insurer needs to build a unified depositor information system, as well as have specific regulations on storing depositor records of banks to ensure the quality of information in case of need.

During the Covid-19 pandemic, the deposit insurer needs to focus on effective policy communication, so that depositors are aware of deposit safety, banking operations, deposit insurance policies, etc. affected by the pandemic. Many international deposit insurers have focused on raising public awareness of the benefits of deposit insurance policies through many new media tools, including social networks such as Facebook and Twitter, typically in Colombia, Indonesia, Hong Kong, Kenya, and Mexico.

Policy communication by the Deposit Insurance of Vietnam - practice and measures

In 2020, the DIV piloted a survey on the awareness level of more than 1,000 depositors at commercial banks, people's credit funds, and microfinance institutions across the country. The survey was made to basically measure the perception of depositors based on their understanding of some basic elements of the deposit insurance policy directly related to their rights and interests, including: the currency of the insured deposits; responsibility to pay deposit insurance premium; the organization responsible for paying the insurance; insurance coverage limit; how to deal with the uncovered deposits.

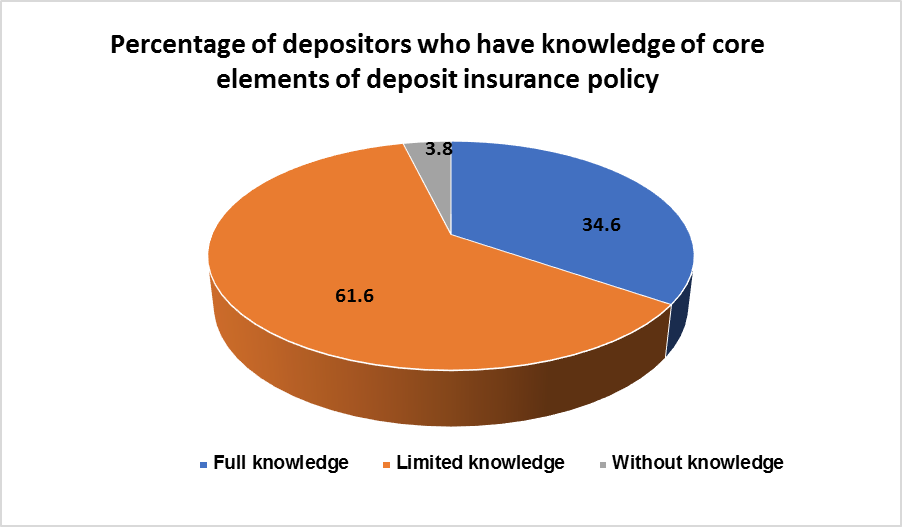

Accordingly, out of 1,069 survey participants, 34.6% understood all the core information about the deposit insurance policy at the same time. This is a low average rate in comparison with the target awareness rate that should be achieved at 55% by 2030 according to the Draft Strategy for Development of Deposit Insurance to 2025, with a vision to 2030. With this target rate, it is necessary to promote the communication of deposit insurance policies in the coming years to increase the awareness level of depositors on deposit insurance policy by at least 20.5% in the next 10 years. At the same time, the majority of participants were partially aware (at least 1 core policy) but did not fully understand the core contents of the deposit insurance policy, accounting for 61.6%. Notably, 3.8% of depositors participating in the survey were completely unaware of any of the above policy elements.

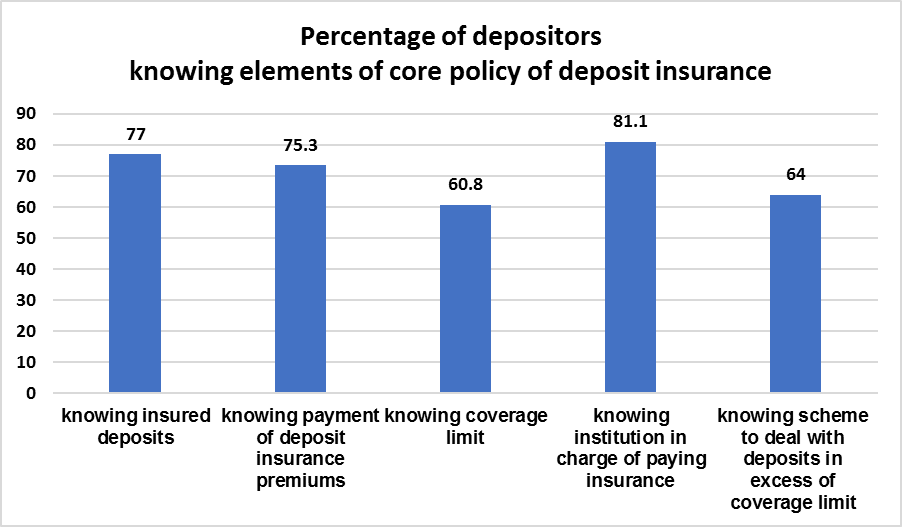

Meanwhile, the rate of specific awareness on each indicator was very high. 77% of survey respondents know about the currency of the insured deposit; 75.3% know that the responsibility to pay deposit insurance premium belongs to deposit - taking credit institutions; 60.8% know about the current insurance coverage limit; 81.1% know that the Deposit Insurance of Vietnam is the organization that will pay the deposit insurance if an insured institution becomes insolvent or goes bankrupt; 64% know that after the insurance is paid, the uncovered deposit will be settled after the liquidation of the failed credit institution's assets. Two contents that are less recognized by depositors compared to the remaining core information are the insurance coverage limit and the uncovered deposit will be paid after the liquidation of the failed credit institution's assets.

The difference between the awareness on each of the basic elements of the deposit insurance policy and the awareness for the core set of deposit insurance policy information indicates the fact that depositors were aware of one or more of the key elements of the deposit insurance policy but with incomplete understanding. The fact is that 84.7% of participating depositors said that their deposits are insured and 85.3% confirmed that they knew about the Deposit Insurance of Vietnam. This relatively large disparity requires further research and investigation to evaluate the effectiveness of each communication program, determine the extent and process of changing awareness to design appropriate programs to set off the current lack of awareness. Especially, the communication to depositors, who know but do not fully understand the deposit insurance policy, will become even more difficult due to awareness barriers.

In early 2022, the Governor of the State Bank of Vietnam (SBV) issued the Directive 01/CT-NHNN dated January 13, 2022 on organizing the implementation of key tasks of the banking industry in 2022, in which the Governor directed to: Enhance the role of the DIV in protecting the legitimate rights and interests of depositors; Complete the application file for the development of the Law on Amendments and Supplements to the Law on Deposit Insurance; submit to the Prime Minister for approval of the Strategy on Development of Deposit Insurance to 2025, with a vision to 2030.

The DIV identifies 2022 as an important year in terms of propaganda to participate in building a general consensus on the deposit insurance policy, promoting the dissemination of the deposit insurance policy to many different groups of the public with diverse communication messages. On the basis of the direction of the SBV, and reference to international practices, and the actual situation of its operations, the DIV should focus on the content and scope of propaganda such as: Raising public awareness on deposit insurance policy, policy implementation activities, deposit insurance operations; Organization, activities and role of the DIV; The important contents of the Deposit Insurance Development Strategy, especially the key and long-term orientations, as well as the DIV's plan to implement the Strategy after it is approved by the Prime Minister; Key contents aimed at amending and supplementing the Law on Deposit Insurance. In addition, the DIV should convey guidelines, policies and directions in the banking sector in order to provide depositors with useful information, and to contribute to the dissemination of general financial and banking knowledge to the public.

In the coming time, for better implementation of the deposit insurance policy, the requirement for the DIV is to take proper measures to improve awareness of depositors, create public confidence in the deposit insurance policy and the banking system.

Firstly, regarding the legal framework and general orientation: It is recommended that the relevant authorities have specific regulations on the responsibilities of insured institutions to participate in the dissemination of deposit insurance policies at the request of the DIV.

Accordingly, insured institutions, in addition to displaying the Certificate of deposit insurance participation, must also publicly post information on the deposit insurance policy at their transaction counters, place information sheets introducing the deposit insurance policy at the locations where deposit transactions take place. Besides, insured institutions should implement communication programs as required by the DIV. It is possible to specify standards of understanding about deposit insurance policies for tellers of insured institutions as needed.

Secondly, the Deposit Insurance development strategy is currently in the process of being finalized and submitted to the Prime Minister for approval. In order to promptly implement the contents set out in the Strategy, the DIV should actively draft and issue the Communication Strategy of the DIV right after the Deposit Insurance Development Strategy is issued, which should be associated with the orientation, goals and solutions of the DIV in the coming time. The DIV should also specify specific propaganda solutions to achieve the propaganda objectives, thereby ensuring a throughout communication mechanism with a clear orientation with a long-term vision, serving as the foundation for the DIV to coordinate with relevant parties in a unified manner.

Thirdly, continue to implement the current methods of propaganda, and at the same time, update and diversify new methods of communication to disseminate the deposit insurance policy more effectively. The DIV should consider and pilot a communication program to promote viral transmission and evaluate its effectiveness to take advantage of this wide-reaching, yet very cost-effective communication channel. For the social media channel, it is necessary to proactively take measures to monitor, thereby promptly capture negative information to correct, propagate and explain, so that the deposit insurer would officially act online by giving an official voice to preserve the confidence of depositors.

In the context that the Covid-19 pandemic may continue to be complicated, in order to avoid the risk of pandemic outbreaks due to large gatherings, it is proposed to pilot propaganda measures through the telecommunications network, specifically using text messages (SMS or OTT multimedia messages) to convey the core contents of the deposit insurance policy to the public segmented by age, gender, location or depositor database, thereby bringing the policy directly to the target audience.

Fourthly, to serve as a basis for the planning of the Communication Strategy of the DIV and the annual plan on communication, it is proposed to assess the level of depositors' awareness on the depositor's policy on the principle of a random sampling survey, to assess the overall perception and behavior of depositors on a nationwide scale with a large sample size conducted by an independent market research agency. In particular, before and after the DIV organizes large-scale communication programs, it is necessary to carry out a number of small-scale quick assessment on a specific target audience to determine the effectiveness of the communication activities on the perception of depositors.

Fifthly, it is essential to strengthen coordination between the DIV and relevant parties to propagate the deposit insurance policy to the public, specifically by: coordinating with the SBV and the provincial branches of the SBV as the state management agency in the banking sector; proposing to the Ministry of Education and Training for coordination in integrating the contents of the deposit insurance policy into the curriculum of all levels from junior high school to university level; proposing to build a comprehensive response coordination mechanism in the event of a crisis in banking operations with a clear division of responsibilities; coordinating with insured institutions as an object and also a beneficiary of the deposit insurance policy in the process of communicating the deposit insurance policy.

Dr. Vũ Văn Long – Deputy General Director of the DIV

Department of Research and International Cooperation (translation)