According to Mr. Nguyen Quoc Hung - General Secretary of the Banking Association, over the past time, the system of credit institutions has been effectively restructured, with some outstanding and positive achievements. The whole system has resolved 760 trillion non-performing loans, especially under Resolution No.42 (over 360 trillion); non-performing loan ratio of credit institutions is always kept below 3%.

In addition, credit institutions also actively improve their positions through the addition of charter capital, strengthening financial capacity (increasing from 488 trillion VND in 2016 to 790 trillion VND by the end of 2020, equivalent to 1.6 times); gradually stabilize and restructure a number of weak credit institutions, creating momentum for the restructuring process in the next phase.

Mr. Vu Van Long - Deputy General Director of DIV said that the deposit insurer has actively participated in the process of restructuring the credit institution system, through the effective implementation of deposit insurance operations such as: offsite supervision for 100% of the insured institutions, on-site examination as planned and in-depth examination under the direction of the SBV. When detecting problems, errors, shortcomings as well as risks and weaknesses, the DIV reports to the SBV for correction and handling.

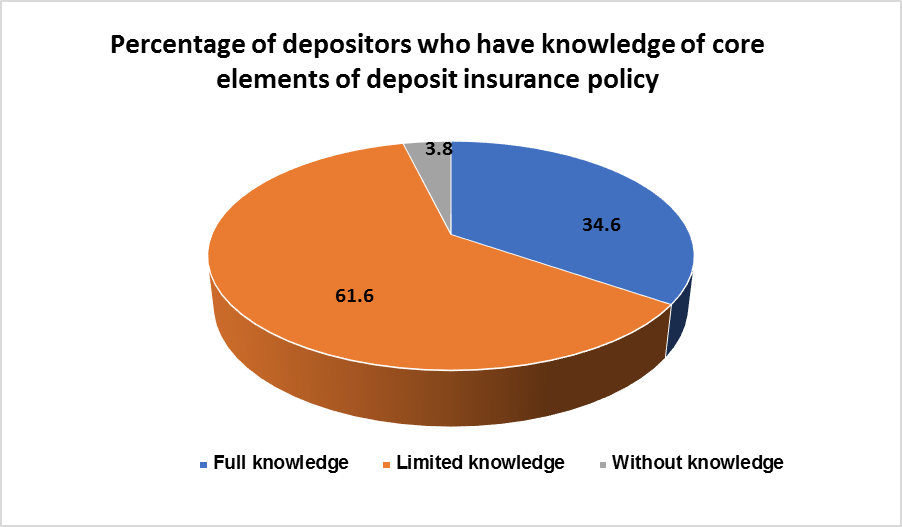

DIV promote deposit insurance policies in order to improve public confidence, contribute to ensuring system safety and reduce risks leading to credit institution failure; promote the process of mobilizing temporarily idle capital from residents to meet the lending needs of credit institutions.

In the process of restructuring credit institutions, ensuring depositors' confidence is very important. DIV commits to pay according to the insurance payment limit as prescribed by law when the participating organization becomes insolvent or goes bankrupt. Since its establishment, the DIV has reimbursed depositors at 39 dissolved or bankrupt People's Credit Funds. Recently, the operation of credit institutions has been stable, so the DIV does not reimburse depositors.

According to Mr. Vu Van Long, the role of the DIV has become clearer and clearer in recent legal documents. In addition to the tasks specified in the revised Law on Credit Institutions (2017), Decision No.689/QD-TTg dated June 8, 2022 approving the Project "Restructuring the system of credit institutions associated with non-performing loans settlement in the period of 2021 - 2025" and Resolution No. 62/2022/QH15 on questioning activities at the 3rd session of the 15th National Assembly... both specify the study, review, amendment and supplement of the Law on Deposit Insurance and other documents relevant legal documents; supplementing functions and tasks of the deposit insurer to participate in restructuring weak credit institutions.

Recently, according to Decision No.1382/QD-NHNN (August 2022) promulgating the Action Plan to implement the project "Restructuring credit institutions associated with non-performing loan settlement in the 2021-2025 period" under Decision No.689 (June 2022), the Governor of the SBV also directed the DIV to continue to review, research, amend and supplement the Law on Deposit Insurance and related legal documents in the direction of supplementing the functions and tasks of the DIV in restructuring weak credit institutions; study to amend the deposit insurance law to use the premium balance to deal with weak PCFs.

These functions and tasks mainly focus on the goal of supporting specially controlled credit institutions to recover and return to normal operations. In addition, the DIV also directly participates more deeply in the restructuring of the People's Credit Fund such as: participating in the Special Control Board for the People's Credit Fund, giving opinions on the plan to restore the specially controlled People's Credit Fund; participating in the formulation of bankruptcy plans, handling/liquidating assets to pay creditors in accordance with the law.

“It can be seen that in the provisions of the law, the role of the DIV has been emphasized and clarified. This is the basis for the deposit insurer to participate more actively and effectively in the next phase of the restructuring process of credit institutions”, emphasized Mr. Vu Van Long.

According to Mr. Vu Van Long, although the DIV plays an important role in the financial network and is an effective tool of the Government and the SBV in protecting the interests of depositors, contributing to maintaining the stability of the system, the provisions on the powers of deposit insurers in the Law on Deposit Insurance and related laws have not been consistent and synchronous, which has limited the effective participation of DIV in restructuring credit institutions.

Typically, the revised Law on Credit Institutions 2017 stipulates that the deposit insurer participates in the development of plans for restructuring the PCF. However, the provisions on the rights and obligations of the deposit insurer in the Law on Deposit Insurance do not ensure that the deposit insurer can participate more deeply in the restructuring process of the credit institutions (for example, participating in supporting the examination and supervision of the People's Credit Funds, participating in the development of plans for restructuring the People's Credit Funds, providing special loans for the People's Credit Funds under special control, etc.).

According to the provisions of the Law on Credit Institutions amended in 2017, the DIV makes special loans to financial companies, people's credit funds, and microfinance institutions; buys long-term bonds of supporting credit institutions according to the decision of the SBV. Meanwhile, the Law on Deposit Insurance has not yet regulated these contents, and there is a lack of sub-law documents guiding the implementation.

In Decision No.689 of the Prime Minister, one of the new tasks of the DIV is specified as the role of supporting examination under the direction of the SBV, but this content has not been mentioned in the Law on Deposit Insurance.

Therefore, it is very practical to assign the task of deposit insurer to participate more deeply and effectively in restructuring the credit institution system. In order to achieve the above objectives, first of all, it is necessary to continue to improve the legal system in the banking sector such as moving towards the legalization of non-performing loan settlement; supplementing and amending the Law on State Bank, Law on Credit Institutions, Law on Deposit Insurance...

Specifically, Mr. Vu Van Long said, DIV has completed the Development strategy of deposit insurance to 2025, with orientation to 2030 to report to the Governor of the SBV for submission to the Prime Minister for approval. In which, it emphasized the role of DIV in participating more deeply and effectively in the process of restructuring the credit institution system and that is one of the important tasks towards amending the Law on Deposit Insurance over the coming time.

A second important task according to Mr. Vu Van Long is that, the DIV has reviewed 10 years of implementation of the Law on Deposit Insurance, thereby proposing amendments and supplements to this Law to meet the requirements of actual operation of the banking industry today. At the same time, ensuring compliance with international practices on developing an effective deposit insurance model.

Furthermore, DIV will strengthen supervision and examination activities for credit institutions during the restructuring process towards performing the role of early warning, as well as timely intervention for potential risks of credit institutions, thereby helping these organizations develop more healthily; report to the SBV to handle institutions that violate regulations on safety in banking operations (if any).

“These will be the foundations for the DIV to have a basis for implementing tasks, especially to participate more deeply in the process of restructuring credit institutions in the coming time”, affirmed Mr. Vu Van Long.