A view from the country with the world's earliest deposit insurance system

In early 2023, the US financial system was shaken, the incident happened very quickly due to banks losing liquidity. The names mentioned are Silicon Valley Bank (SVB) - a bank with 40 years of operation in the US - which was forced to stop operations after customers massively withdrew money. Two days after SVB's collapse, New York state authorities rushed to take over Signature Bank (SB) to prevent systemic risks in a context of declining confidence. Next is First Republic Bank (FRB) - a commercial bank specializing in providing services to individuals with high net assets...

Notably, the rapid and unpredictable developments shocked bank executives and showed the "fragility" of the banking system. “We did not see any unusual signs until customers rushed to withdraw money on Friday. That is clearly due to the impact of the collapse of SVB" - a member of the SB board of directors stated.

However, these incidents did not cause widespread consequences in the financial market because of the intervention of the US Government and the Federal Deposit Insurance Corporation (FDIC). Faced with crises like those of SVB and SB, in order to strengthen people's trust in banking activities and avoid mass withdrawals, FDIC and licensing agencies have closed banks, appointing FDIC as the organization to receive and transfer all operations of the failed bank to the bridge bank to continue to maintain the provision of banking services and accounts for existing customers before being transferred to the transferee organization. At the same time, US law allows FDIC to share losses with the transferee organization. To prevent the risk of mass withdrawals, FDIC has declared a guarantee for all deposits at SVB and SB... (including deposits exceeding the deposit insurance coverage limit and uninsured deposits).FED has established a lending program to support liquidity for banks, including buying back bonds at face value (not at market price) to support liquidity and reduce losses for holding banks. bonds... These moves are aimed at regaining public trust, maintaining continuous operations and customers' ability to access banking services, ensuring the rights of depositors has minimized the negative effects of bank bankruptcy.

It can be seen that the above banks all went bankrupt due to “classic” reasons: a wave of customers massively withdrawing money and running away from the bank; At the same time, these banks have a very high amount of deposits outside the scope of deposit insurance and depositors can withdraw money through electronic banking operations after only a short notice. A recent study in the US showed that nearly 190 banks in this country are at risk of bankruptcy even if only half of the depositors not covered by the deposit insurance decide to withdraw their money. Uninsured depositors would lose part of their deposits if the bank collapsed, so they would have an incentive to withdraw their money. Uninsured deposits are deposits of depositors that greater than the FDIC's $250,000 deposit insurance coverage limit.

According to a recent report from the FDIC, uninsured deposits in the banking system remain high and peaked in 2021. In particular, uninsured deposits are concentrated in large banks and belong to large banks. a small number of depositors. In 2022, less than 1% of deposit accounts will have a balance exceeding the deposit insurance limit, but in terms of value, the total balance of these accounts for more than 40% of the total value of deposits in the banking system. At SVB, at the time this bank collapsed, the 10 largest deposit accounts here were worth up to 13.3 billion USD.

The failure of US banks in the first months of 2023 shows that, no matter where, whether it is a country with the most developed financial system and banking system, along with the earliest and most advanced deposit insurance system. As the most advanced in the world like in the US (FDIC was established in 1933), depositors are always the most sensitive and vulnerable public to information about banking activities. Although the American are already "familiar" with bank closures (during the 2008 - 2009 financial crisis, in the US there were up to 11,000 banks going bankrupt). When signs appear that their deposits are at risk of insecurity, small depositors can quickly collapse giant banks with decades of operations in the market. Therefore, promptly protecting, reassuring, and stabilizing the psychology of depositors is a vital factor to ensure the safe and sustainable development of each individual bank or the entire credit institutions system.

Upgrade depositor protection early and remotely

The bank bankruptcies that shook the United States are said to have no impact on Vietnam. Because currently, our country's banking system operates with higher standards (many banks have applied Basel II and Basel III), which is an important foundation to strengthen market confidence, contributing to promoting development. Safety development of the system of credit institutions.

On the other hand, recently, the State Bank of Vietnam (SBV) has always responded quickly, proactively and ready to intervene to stabilize the market when a credit institution shows signs of doubt. For example, in 2022, Sai Gon Joint Stock Commercial Bank (SCB) had a difficult time, but did not cause widespread collapse thanks to flexible and timely intervention measures, including widespread statements in the mass media. that the interests of depositors are guaranteed to the highest extent; On the other hand, thanks to market confidence that has been consolidated for quite a long time.

Lessons from bank failures in the US and a number of other countries around the world in the first months of 2023 have been studied by the SBV - the agency in charge of drafting the amended Law on credit institutions in Vietnam - to research and quickly add a series of regulations to "refresh" the early intervention process for credit institutions, especially with the participation of the deposit insurance organization to protect depositors early and remotely. And to ensure there is a timely response mechanism when a situation arises where a credit institution has a mass withdrawal of money that risks affecting or threatening the system's safety, the draft Law adds regulations on resolving measures when mass withdrawal incident occurs. Accordingly, the draft Law supplements the authority of the SBV at the early intervention stage, raising a number of measures currently applied at the special control stage to the early intervention stage to early resolve the weak situation of credit institutions. Additional support measures from supporting credit institutions and the participation of DIV are also included. Supplementing regulations on cases where credit institutions receive special loans from the SBV, DIV, Cooperative Bank off Vietnam and other credit institutions - even when those credit institutions have not been placed under special control for settlement and resolve the problem of customers withdrawing money in bulk at the credit institution, thereby indirectly protecting depositors.

Explaining this when the National Assembly discussed the amended Law on credit institutions at the first session of 2023, Governor of the SBV- Nguyen Thi Hong indicated that a bank is operating normally, but for some reason there is a mass withdrawal of money , all need to be included in the early intervention process for timely support. If you wait until you are under special control to implement support solutions, it will be difficult to ensure system safety.

The Law on deposit insurance being proposed to be amended by the SBV also aims to better protect the interests of depositors, including shortening the insurance payment period and creating a mechanism to improve the financial capacity of deposit insurance organizations.

Communication is like traffic - you need to go first and pave the way

The financial market is inherently sensitive, with strong crowd psychology effects. Therefore, transparency and market discipline along with regularly improving the effectiveness of depositor protection are very important. Protect depositors not only by legal regulations and economic measures but also by disseminating, explaining and communicating financial policies - financial services - mechanisms to ensure the safety of financial activities of people in a systematic way, creating a financial market information ecosystem. Therefore, improve people's understanding, positively impact the "path" from their awareness to their behavior when participating in financial activities, and at the same time shorten the "distance" from culture to financial activities. version to practice.

To strengthen policy communication, the Prime Minister issued Directive no. 07/CT-TTg dated March 21, 2023, which clearly states: in the context of the current information explosion, policy communication needs to be focused, improving professionalism, contributing to creating consensus, improving efficiency and effectiveness in policy implementation.

Previously, the Prime Minister approved the National Comprehensive Financial Strategy to 2025, with a vision to 2030 in Decision no. 149/QD-TTg dated January 22, 2020. In particular, an important content is to increase financial literacy for people with the goal of changing awareness, behavior and creating good financial habits in the community.

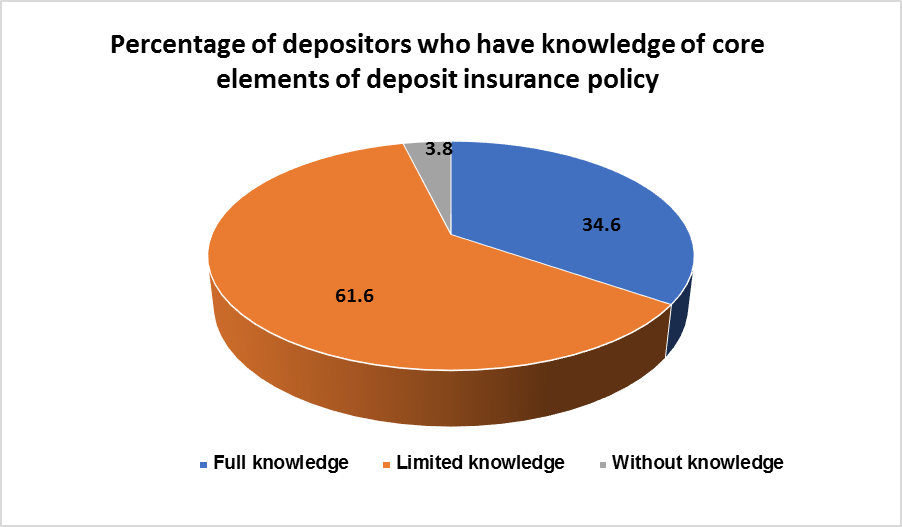

Regarding deposit insurance - the Government's public policy tool to protect depositors, the Strategy on deposit insurance development to 2025, orientation to 2030 sets the target of having 45% by 2025 and 55% by 2030 depositors captures the core contents of deposit insurance policy. Therefore, with the function of protecting the legitimate rights and interests of depositors, the deposit insurance organization needs to urgently realize this goal, thereby increasing the level of awareness of depositors about deposit insurance.

For credit institutions, if they want to develop sustainably, they need to pay attention to both aspects of their operations, including growth while still controlling risks and building themselves "smart customers and depositors". Credit institutions need to promote combination and integration of promoting new banking products with communication on finance and banking policies, including deposit insurance. A leader of the SBV once noted that credit institutions must regularly update information on monetary policy and banking operations of the Government and the SBV on the credit institutions' websites "so that many people and depositors can notice". Depositors give capital - also giving trust to credit institutions, but depositors themselves can turn their backs and collapse credit institutions once trust decreases. Lack of cooperation from credit institutions in policy communication activities can cause a "break" in the path of policy information to the people. There is rarely a person who does not have a transaction relationship with a credit institution.

Regarding deposit insurance, the current Law on deposit insurance only stipulates that credit institutions must publicly post the Certificate of participation in deposit insurance at transaction points that receive deposits from depositors. In fact, realizing the importance of deposit insurance, some banks also print on their savings books the following content: customer deposits are insured according to regulations. Or in the content "things to note" on the back of the blank savings book form of the People's Credit Fund (PCFs), it also publicly inform that savings deposits of members and customers at the PCFs are insured for deposits ( PCFs is currently only allowed to use blank savings books according to the form issued and provided by the Cooperative Bank of Vietnam to receive savings deposits from customers). In the coming time, when amending the Law on deposit insurance, the legislature needs to consider legislating the responsibilities of credit institutions in coordination with deposit insurance organizations to promote broader and more systematic participation of credit institutions in policy communication, associated with banking products and services.

The Law on Protection of Consumer Rights recently passed by the National Assembly in June 2023 still leaves an important segment of financial service consumers- depositors. The reason is a specific subject that needs to be regulated by specialized laws. Therefore, soon amending the Law on credit institutions, Law on deposit insurance... with upgraded and supplemented regulations to better protect the interests of depositors will be a driving force for people to put idle money into the economic flow through credit institutions.

Communication Department