At the Summit meeting of G20 leaders in November 2011, the financial consumer protection policies were included in their regulatory and supervisory frameworks as financial consumer protection would promote financial inclusion, financial stability and promote the development of national financial markets. The Organization for Economic Co-operation and Development (OECD) and the World Bank (WB) also issued the High Level Principles on Financial Consumer Protection (2012) and Good Practices on financial consumer protection (2017) respectively.

The International Association of Deposit Insurers (IADI) has engaged in activities to strengthen financial consumer protection and financial inclusion of the G20 as an international standards-setting body. IADI has established the Financial Inclusion and Innovation Subcommittee (FIIS) under the Research and Guidance Committee, which acts as a forum for deposit insurers around the world to promote the role of deposit insurance policy in financial consumer protection. Together with the Basel Committee on Banking Supervision (BCBS) and the International Association of Insurance Supervisors (IAIS), IADI has implemented many activities to exchange experiences and support members to contribute more on financial inclusion and consumer protection campaigns.

The deposit insurer's contribution to financial consumer protection

According to FIIS, IADI as well as deposit insurers around the world play an important role in protecting financial consumers, such as: ensuring public policy goals, promoting initiatives and progress, improving depositors' awareness of deposit insurance.

The public policy objectives of deposit insurers should go hand in hand with protecting financial consumers. The role of the deposit insurers will be most effective when it is specified in legal documents on banking safety, supervision and deposit insurance. In addition, there should be coordination among the members of the Financial Safety Net and the supervisory authorities. In fact, the role of the deposit insurers in protecting financial consumers is limited, if any, it has not been formalized in the Law and sub-law documents.

However, the contribution of the deposit insurance system is still recognized through the function of protecting small depositors. Small depositors are often considered to have limited information, especially depositors at non-banking credit institutions and microfinance institutions. However, in some countries, such types of small-scale credit institutions have not yet participated in the deposit insurance system, but most in the form of microfinance institutions under banks or banking credit unions. Some countries such as Mexico and Albania are considering allowing non-bank microfinance institutions to participate in the deposit insurance system, as well as setting respective coverage limit and fees for such cases.

The process of modernizing the financial - banking industry is taking place strongly at banks and non-bank credit institutions, leading to an increase in electronic deposits, mobile deposits, and online banking services. Banks are digitalized, but depositors do not have much understanding of these aspects. Risks for deposit insurers may be increased by these types of digital financial services and specific regulation for protecting electronic deposits may be required.

Currently, most deposit insurers have complete and clear regulations on the type of insured deposits and some countries are considering revising their regulations to accommodate changes in digitalization, especially the European region. The US Federal Deposit Insurance Corporation (FDIC) applied a safe deposit account pilot program in 2011 for electronic transactions for debit cards; partnering with organizations such as Cities Group, Economic All-Inclusive Union (AEI) and Financial Opportunity Center (LISC) to connect services for depositors in non-bank institutions.

At the same time, it is necessary to raise the awareness of depositors about banking and deposit insurance policy through communication activities of the deposit insurer. Up to 70% of deposit insurers implement public awareness programs with the main target audience being small depositors and households about the benefits of deposit insurance policy, including deposits in non-bank financial institutions. In Asia, in the field of financial education, the Philippine Deposit Insurance Corporation (PDIC) has coordinated with the Ministry of Education to implement the Financial Education Project for high school students; coordinated with the Central Bank and a group of large commercial banks to organize the movement "Wise savers" for students and office workers.

Some suggestions for Vietnam

In Vietnam, consumer protection is mainly based on the legal basis of the Law on Protection of Consumer Rights, but there is no separate regulation on financial consumer protection. Meanwhile, laws in the financial fields such as the Law on Credit Institutions, the Law on Securities, the Law on Insurance Business have provisions on protecting the interests of customers but are incomplete and lack guidelines. specifically, promptly and effectively handle complaints of financial consumers. In addition, Vietnam does not have specialized organizations to centrally manage financial consumer protection.

The Industrial Revolution 4.0 has created obvious changes in the financial sector, creating new development channels for financial products and services, especially digital financial products and services. Compared with developing countries, Vietnam has certain advantages in implementing financial inclusion such as information technology platform, wide coverage of digital services, strong development, etc. financial service providers, the active support of international development partners... The National Comprehensive Financial Strategy to 2025, orientation to 2030 has set out a group of solutions on protection Financial consumers are: Financial education, financial literacy and capacity building, financial consumer protection.

In the field of deposit insurance, over 20 years of operation, Vietnam Deposit Insurance has made a significant contribution in protecting financial consumers - depositors at credit institutions. By the end of June 2021, the Vietnam Deposit Insurance has protected more than 6 million billion VND of deposits of depositors at 1,283 organizations participating in the deposit insurance, including: 97 banks and foreign bank branches, 1,181 people's credit funds, 01 cooperative bank and 04 microfinance institutions. DIV protects depositors by performing key operations such as monitoring and inspecting member organizations to promptly detect weaknesses and errors in the operation process, participate in the handling of credit institutions, pay insured deposits according to the limit and propagate and disseminate deposit insurance policies to depositors.

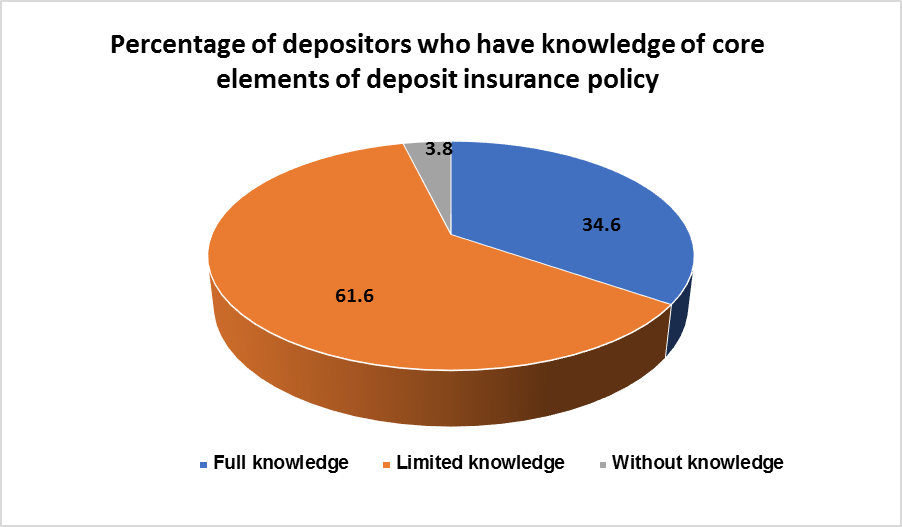

The Deposit Insurance of Vietnam (DIV) has gradually planned communication objectives for each period of time, categorised the target audience and selected appropriate means of communication. Currently, the DIV has determined to target at depositors in rural, remote and isolated areas where there is little access to information of finance, banking and deposit insurance. DIV has diversified forms of communication and dissemination of deposit insurance policy such as: official website, printed and electronic newspapers, radio and television, the exclusive communication channel of Vietnam Post Corporation, local events to raise awareness of People credit funds’ members, contests and events for university students etc.

In order to enhance the role of the DIV in protecting financial consumers, the following solutions should be considered:

Regularly evaluate the effectiveness of protecting financial consumers – depositors on the basis of the Core Principles for effective deposit insurance system and the relevant assessment methodology. Hence, identify the results and limitations in protecting financial consumers such as financial products and digital deposits, transaction methods or non-bank services for the poor in relation to deposit insurance.

Continue to insure financial services and products such as online deposits within the scope of the Law on Deposit Insurance to meet the deepening innovation of current financial and banking activities, especially deposits of small and individual depositors. Research on amending and supplementing the specific regulations for the electronic deposits.

Focus on enhancing the role of communication and promote deposit insurance policy to the public. Actively coordinate with competent agencies such as the State Bank of Vietnam to organize more financial education programs for people in localities. Implement and evaluate the effectiveness of communication activities through periodical surveys; thereby building a suitable communication strategy for each period.