International experience

According to international experience, the lending mandate of the deposit insurer is one of the forms of financial support measures for weak credit institutions. According to the International Association of Deposit Insurers (IADI), financial assistance is support from a third party, such as government agencies, resolution agencies or deposit insurers, to credit institutions in difficulty in various forms such as loans, guarantees, subsidies, deposits, tax exemptions, asset acquisitions, debt acquisitions, capital injections or cost-sharing agreements. Financial assistance can be aimed at directly providing capital to the resolved institution through direct lending, assisted mergers, asset acquisitions, etc., or providing capital for another resolution activity such as transfer, bridge banking, or financial support to ensure effective resolution.

In Korea, the lending of the Korea Deposit Insurance Corporation (KDIC) to financial institutions is regulated in Article 38 of the Depositor Protection Act: KDIC may provide financial support to insured institutions under the decision of the Financial Services Commission, if the following conditions are met: There is an application for financial support or when necessary to ensure that a merger involving an insolvent financial institution is carried out; When it is deemed necessary to strengthen the financial structure of a failed financial institution to ensure the rights of depositors and maintain the stability of the credit system; When the Financial Services Commission requests the provisions of the Financial Sector Structure Improvement Act". Currently, KDIC provides financial support through a number of forms, such as equity investment, capital contribution, asset purchase, lending, etc.

In Taiwan, lending to insured institutions by the Central Deposit Insurance Corporation, Taiwan (CDIC) is regulated in Clause 3, Article 28, and Article 29 of the Taiwan Deposit Insurance Act. Specifically: CDIC must "Provide other insurance participating institutions or financial holding companies with funds, loans, deposits and guarantees, or by purchasing subordinated debts of the closed insurance participating institution or financial holding company to facilitate the acquisition or assumption of all or part of the business, assets and debts of the closed insurance participating institution; when the institution is seriously undercapitalized and the competent authorities deem it unviable and will be closed; the above-mentioned institution is placed under control or the competent authority will take over the authority of the Board of Directors and the Supervisory Board; the handling will cause the prescribed situations. The resolving procedure shall be developed by CDIC and submitted to the competent authority for approval."

For the Deposit Insurance Corporation of Japan (DICJ), Article 59 of the Deposit Insurance Act stipulates: "A financial institution that carries out a merger that is not a failed financial institution or a bank holding company that carries out a merger may apply to the DICJ to take the following measures to support the merger: (i) Providing funds; (ii) Lending or depositing money; (iii) Acquiring assets; (iv) Guaranteeing obligations; (v) Assuming obligations; (vi) Purchasing preferred shares; and (vii) Compensating creditors for damages in the event that debts are not repaid or fully repaid."

According to the 2022-2023 annual report, DICJ can apply methods such as capital injection, financial support with support amount exceeding insurance payment costs, special crisis management (temporary nationalization) for insured institutions whose failure is determined by the Prime Minister to seriously affect the credit system in Japan or the region where the insured institutions operate.

Financial support from the Indonesian Deposit Insurance Corporation (IDIC) to credit institutions under Indonesian regulations is considered a temporary capital contribution, not a loan (as stipulated in Article 27, Article 37 of the Law on Deposit Insurance of Indonesia).

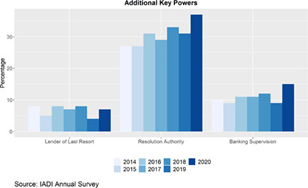

There is also the Lender of Last Resort function of central banks, which aims to provide financial support to credit institutions in case of emergency. According to the IADI survey in 2024, there are currently six deposit insurers with this function, including: HAOD (Croatia); COSEDE (Ecuador); GDGB (Gibraltar); CBRSM (San Marino); NCUA (USA).

Practice in Vietnam

Before the Law on Credit Institutions 2024 takes effect, the DIV provides special loans in accordance with the provisions of the Law on Credit Institutions 2017 and the Circulars regulating special loans for credit institutions under special control of the State Bank of Vietnam (SBV). Accordingly, the DIV provides loans in 3 cases: (i) Special loans to support liquidity; (ii) Special loans according to the decision of the SBV; (iii) Special loans according to the approved recovery plan. During this period, the DIV has received a number of requests for special loans from various credit funds (PCFs). However, the DIV

has not yet issued special loans for any of the above cases. Based on the synthesis of practical loan requests, the following reasons can be drawn:

Cases of requesting liquidity support loans are assessed as not having sufficient ability to repay debts, not meeting the lending conditions as prescribed by Law, and by DIV. These units are mostly in a very weak state, have large bad debts, and lack collateral to meet the requirements.

There has been no special lending case according to the decision of the SBV.

The recovery plan developed by the PCFs proposed a special loan from the DIV; however, through the assessment results of the DIV, the plan did not have sufficient basis for lending, or the units did not meet the conditions for special lending. Therefore, after the DIV participated in assessing the feasibility of the recovery plan, the units did not submit special loan applications to the DIV.

According to the provisions of the Law on Credit Institutions 2024, the DIV shall provide special loans in the following cases: (i) Special loans to commercial banks cooperative banks, and microfinance institutions to support the implementation of recovery plans; (ii) Special loans to commercial banks that are compulsorily transferred to implement compulsory transfer plans; (iii) Special loans to commercial banks, cooperative banks, PCFs, and microfinance institutions when they are subject to mass withdrawals. However, there are still many difficulties and obstacles for the DIV to be able to implement this service in practice, for example:

The Law on Deposit Insurance has not been amended or supplemented with provisions on special lending, so the DIV cannot provide special lending until the Law on Deposit Insurance is amended or supplemented with detailed provisions on special lending.

The special lending subjects of the DIV are weak credit institutions that are very susceptible to loan capital losses, so there must be regulations on handling losses for unrecoverable loans. Meanwhile, the Law on Credit Institutions 2024 does not stipulate the principles for handling special loans of the Vietnam Deposit Insurance when risks occur.

DIV was not involved in assessing the feasibility of the recovery plan for commercial banks, cooperative banks, and microfinance institutions, so it did not have information about the recovery plan offering support measures in the form of special loans from DIV.

The financial capacity of the DIV needs to continue to be improved to perform the task of special lending, at the same time, perform the task of reimbursement, and participate in resolving large-scale credit institutions such as banks. Currently, there are only regulations allowing the DIV to sell government bonds, sell long-term bonds of supporting credit institutions, sell SBV bills to reimburse insurance to depositors in case the operational reserve fund is not enough to reimburse the deposit insurance, there are no regulations on selling government bonds in case the operational reserve fund is not enough to make special loans.

Suggestions

Currently, the SBV, as the leading unit, is coordinating with relevant ministries, branches, and agencies to propose to the Government to submit to the National Assembly amendments and supplements to the Law on Deposit Insurance. For the DIV to be able to carry out its special lending tasks, the following solutions need to be implemented:

First, amend and supplement the legal provisions on the organization of special lending by the DIV. Some tasks of the DIV are stipulated in the Law on Credit Institutions 2024, but have not been stipulated in the Law on Deposit Insurance, especially the task of special lending. Therefore, it is necessary to amend the Law on Deposit Insurance to ensure consistency with the Law on Credit Institutions 2024. The DIV needs to continue to coordinate with the SBV and related units to study and propose contents on special lending expected to be included in the Law amending and supplementing a number of articles of the Law on Deposit Insurance, such as specific regulations on special lending cases, authority to decide on special lending, conditions for the DIV to provide special lending, regulations on collateral, measures to handle irrecoverable loans, etc. to have a basis for implementation in practice, especially for weak credit institutions, without collateral or losing/at risk of losing their ability to pay.

In addition to amending the Law on Deposit Insurance to synchronize with the Law on Credit Institutions in 2024, it is necessary to continue researching and proposing to add to the Law on Deposit Insurance the contents on the support of the DIV for insured institutions that are under special control and are insolvent or at risk of insolvency to reimburse depositors in order to participate more deeply in the restructuring process of weak credit institutions in Vietnam.

Second, improve and develop the resources of DIV.

Regarding financial resources, the DIV continues to have solutions and research, propose amendments and supplements to the provisions of the Law on Deposit Insurance on investment activities of the DIV's temporarily idle capital such as diversifying forms and investment portfolios on the basis of ensuring the principle of capital preservation and development to enhance the financial capacity of the DIV. Regarding human resources, the practical experience of the DIV's staff in implementing special lending is still limited. Therefore, the DIV needs to continue organizing specialized training courses, inviting experts in banking and finance, especially those with practical experience in special lending, to share and exchange experiences; sending staff to participate in domestic and foreign training courses on special lending operations. In addition to training and developing existing human resources, the DIV also needs to develop policies to attract human resources with experience in special lending to work for the DIV.

Third, it is necessary to supplement the information sources that DIV can access from the SBV in order for DIV to be able to perform its special lending tasks well. It is extremely necessary to collect complete, timely, and accurate information. Information on the financial situation, recovery plans, compulsory transfer plans, credit institutions receiving compulsory transfers for compulsory transfer plans, support measures for implementing restructuring plans, etc., needs to be shared and provided by the SBV so that DIV has a basis and basis for assessment and decision making during the special lending process.

Fourth, international experience shows that although the laws in some countries have provisions on the implementation of special loans by deposit insurers, recently, special loans have rarely been used by deposit insurers to participate in the restructuring of weak credit institutions. However, they often use other measures such as P&A, loss sharing, etc. Therefore, it is necessary to continue researching and referring to international experience and actual conditions in Vietnam to propose additional financial support measures of the DIV for insured institutions to be more suitable in the process of resolving incidents and crises in the operations of credit institutions, avoiding the risk of systemic risks, ensuring the stability and safety of the credit institution system.

Communication Department (Translation)