The deposit insurance coverage limit is the maximum amount that the deposit insurance reimburses for all deposits of an insured depositor at an insured institution when the obligation to reimburse arises.

International practices on deposit insurance coverage limit

Principle 8 of the Core Principles for Effective Deposit Insurance Systems of the International Association of Deposit Insurers (IADI) recommends that retaining should clearly define the level and scope of deposit coverage. Coverage should be limited, credible and cover the large majority of depositors but leave a substantial amount of deposits exposed to market discipline. Deposit insurance coverage should be consistent with the deposit insurance system's public policy objectives and related design features. This principle also comes with a number of essential criteria to specify the necessary requirements to develop suitable coverage limits in each country, typically: (1) The level and scope of coverage are limited and are designed to be credible, to minimize the risk of runs on banks and do not undermine market discipline. The level and scope of coverage are set so that the large majority of depositors across banks are fully protected while leaving a substantial proportion of the value of deposits unprotected. The coverage limit needs to fully protect about 90 - 95% of depositors; (2) The deposit insurance applies the level and scope of coverage equally to all of its member banks; (3) The level and scope of coverage are reviewed periodically (e.g. at least every five years) to ensure that it meets the public policy objectives of the deposit insurance system.

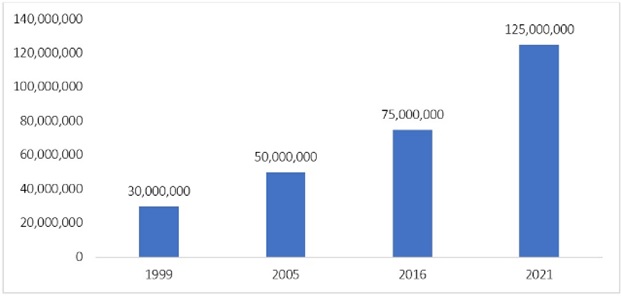

History of deposit insurance coverage limit adjustment in Vietnam

The Deposit Insurance of Vietnam (DIV) was established on November 9, 1999. In Decree No. 89/1999/ND-CP on deposit insurance, the Government stipulated that the maximum deposit insurance amount to be paid to all deposits (including both principal and interest) of an individual at an insured institution shall be 30 million VND.

After 5 years of operation, in 2005, in Decree 109/2005/ND-CP amending Decree 89/1999/ND-CP, the Government increased the deposit insurance coverage limit to 50 million VND to adapt to socio-economic changes .

By 2012, the legal basis for deposit insurance was completed when the 13th National Assembly passed Law No. 06/2012/QH13 dated June 18, 2012 on Deposit Insurance. Article 24 of the Law on Deposit Insurance stipulates: (1) Insurance limit is the maximum deposit insurance coverage to be paid by the Deposit insurance organization for all insured deposits of a depositor with an insured institution when insurance payment duty arises; (2) The Prime Minister shall set the Insurance limit for each period on the basis of the proposal of the State Bank.

In 2016, realizing that the deposit insurance coverage limit kept at 50 million VND for a long time was no longer suitable for the actual situation, The DIV developed the deposit insurance coverage limit scheme, to the State Bank of Vietnam to submit to the State Bank of Vietnam to submit to the Prime Minister to increase the deposit insurance coverage limit to 75 million VND. On June 15, 2017, the Prime Minister issued Decision No. 21/2017 on the deposit insurance coverage limit effective from August 5, 2017, accordingly, the deposit insurance coverage limit was increased to 75 million VND. At the time of 2017, with the limit of 75 million VND, the ratio of fully insured depositors to the total number of insured depositors was 87.32%.

In 2020, based on the macroeconomic and the banking system situation, data on the rate of fully insured depositors, DIV's financial capacity, and international experience on deposit insurance coverage limits, the DIV developed a scheme on deposit insurance coverage limit, suggested the State Bank of Vietnam to submit to the Prime Minister to increase the deposit insurance coverage limit to 125 million VND. On October 20, 2021, the Prime Minister issued Decision 32/2021/QD-TTg on deposit insurance coverage limit effective from December 12, 2021. moronic, the deposit insurance coverage limit is increased to 125 million VND. As of 2020, with a limit of 125 million VND, the ratio of fully insured depositors to the total number of insured depositors is 90.72%.

Figure: History of deposit insurance coverage limit adjustment in Vietnam

(Unit: VND)

Adjusting the deposit insurance coverage limit to 125 million VND is consistent with the financial capacity of the DIV at that time. As of the end of 2020, the operational reserve fund of the DIV reached 64.27 trillion VND, and the total capital of DIV reached 70.58 trillion VND. With a coverage limit of 125 million VND, the operational reserve fund of DIV ensures immediate payment to 100% of the people's credit funds, or immediate payment to 1 lower-ranking bank of the large group, or 3 higher-ranking banks the average group , or 7 lower-ranking banks of the average group, or 16 higher-ranking banks of the small group. Therefore, there has not been a requirement to increase deposit insurance premiums therefore lessening the financial burden for insured institutions. Thus, the DIV ensures that there are enough resources to respond when risks occur without requiring an increase in deposit insurance premiums, which lessens the financial burden for insured institutions.

Deposit insurance coverage limit policy according to the orientation of the Deposit Insurance Development Strategy

On December 30, 2022, the deposit insurance development strategy was approved, enhancing the role of the DIV. This is an important milestone in determining the future direction for the Vietnamese deposit insurance system. The orientations and goals identified in the Deposit Insurance Development Strategy affirm the role of the deposit insurance in the Vietnamese banking system, and at the same time confirm that the development orientation of the Vietnamese deposit insurance system is in accordance with international practice.

Regarding the deposit insurance coverage limit, the Deposit Insurance Development Strategy sets the goal of increasing the ratio of fully insured depositors to the total number of insured depositors to 92 - 95% by 2030. To achieve this goal, the Deposit Insurance Development Strategy also provides solutions to periodically review, evaluate the suitability, and propose adjustments to the deposit insurance coverage limit.

Specific objectives and solutions for deposit insurance coverage limits in the Deposit Insurance Development Strategy are consistent with international practices and practical conditions in Vietnam. Currently, the ratio of fully insured depositors to the total number of insured depositors in Vietnam is consistent with IADI recommendations (the coverage limit needs to fully protect about 90 - 95% of depositors) but is still relatively low compared to other countries in the same region. region. According to IADI's 2013 Enhanced Guidance for Effective Deposit Insurance Systems: Deposit Insurance Coverage, other factors can affect the determination of deposit insurance coverage limit, including the availability of funds, stage of economic development, linkages with neighboring countries, or the existence of multiple deposit insurance systems within a country. If the capital flow of funds between neighboring countries is large, the deposit insurance coverage limits of these neighboring countries need to be considered when determining regulations on deposit insurance coverage limits. For example, differences between the deposit insurance coverage limits of neighboring countries can lead to bank runs.

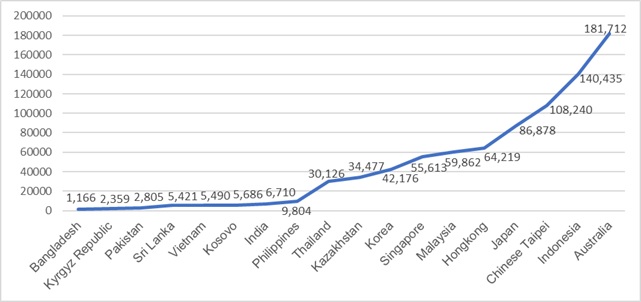

According to the IADI 2022 annual survey, Vietnam's deposit insurance coverage limit (in USD) is the 5th lowest among 18-member deposit insurers of the Asia-Pacific Regional Committee (APRC) participating in the survey, higher only than Bangladesh, Kyrgyz Republic, Pakistan, and Sri Lanka.

Figure: Deposit insurance coverage limits of APRC member deposit insurers

(Unit: USD)

>Source: IADI 2022 annual survey results (results as of December 31, 2021)

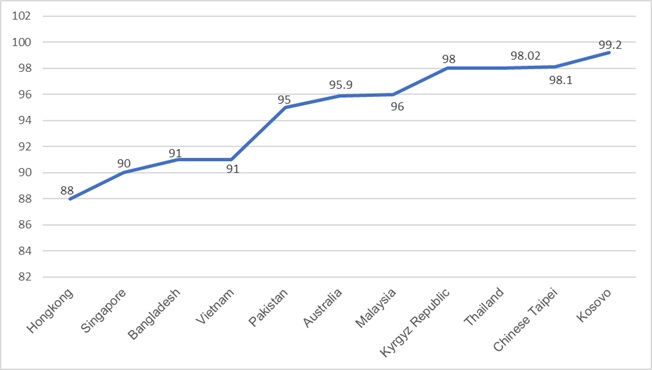

Regarding the ratio of fully insured depositors to the total number of insured depositors, as of December 31, 2021, with a deposit insurance coverage limit of 125 million VND, the deposit insurance coverage limit in Vietnam Nam protects 91% of depositors, lower than many countries in the region such as Chinese Taipei (98.10%), Thailand (98.02%), Malaysia (96%)...

Figure: Ratio of fully insured depositors to total insured depositors at some APRC member deposit insurers

>Source: IADI 2022 annual survey results (survey results as of December 31, 2021)

In addition, the periodic review and evaluation of the appropriateness and adjustments to deposit insurance coverage limit during the implementation phase of the Deposit Insurance Development Strategy is in accordance with IADI's recommendations (deposit insurance coverage limit level and scope is reviewed periodically ( e.g. at least every five years) to ensure that it can meet the public policy objectives of the deposit insurance system). IADI's 2013 Enhanced Guidance for Effective Deposit Insurance Systems: Deposit Insurance Coverage also recommends that deposit insurance coverage limit should be reviewed, reassessed regularly, and adjusted appropriately based on factors such as inflation, changes in people's income, the size of depositors' deposits, market expectations and other factors affecting public policy goals.

In the coming time, to implement the Deposit Insurance Development Strategy, the DIV needs to periodically review and evaluate the appropriateness of the deposit insurance coverage limit. When determining the need to adjust the deposit insurance coverage limit, the DIV proceeds to develop a deposit insurance coverage limit scheme, which evaluates the macroeconomic situation (including factors such as GDP growth rate, GDP per capita, inflation...), banking system situation, data on depositors and insured deposits, percentage of depositors fully insured, the DIV's financial capacity, international experience on deposit insurance coverage limit... From there, the DIV should propose an appropriate deposit insurance coverage limit, aiming for the ratio of fully insured depositors to the total number of insured depositors reach 92 - 95% to better protect the legitimate rights and interests of depositors.

Research and International Cooperation Department