1. Role of central banks in maintaining financial stability – from a macro-economic view

According to ECB (2011), financial stability is a context in which the financial system (including intermediaries, markets and infrastructure) is competent to cope with shocks and avoid financial imbalance. The possibilities of failure in intermediary processes, which may seriously affect the resource allocation from saving to investment, then can be minimized. In simple words, a stable financial system is the one which: i) allocates economic resources effectively (to boost economic growth, social prosperity…); ii) assesses, allocates and manages financial risks properly; iii) performs its functions even with external shocks (Cihak, 2006).

Maintaining financial stability has been widely recognized as an essential task of a central bank. A survey by Bank of International Settlement (BIS) shows that 90 per cent of central banks all over the world have full or partial mission of maintaining financial stability (BIS, 2008). Though not all central bank laws clearly stipulate the role in maintaining financial stability, when a central bank executes its core task of implementing monetary policy, it makes contribution to financial stability in a way that the nation with tamed inflation can uphold financial stability. Besides, other functions of a central bank such as licensing, monitoring, liquidity assisting through the role as a lender-of-last-resort also help conserve an orderly settlement system contributing to financial stability.

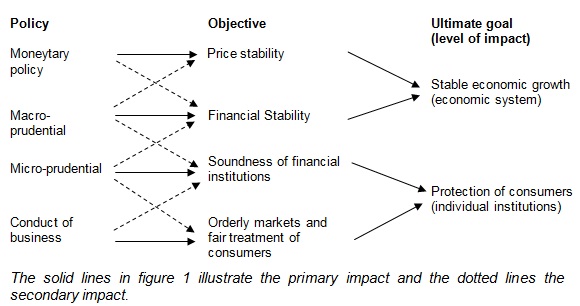

Figure 1 presents an overview of policy framework for keeping financial system stability. To gain the overall stability, some objectives should be met: i) monetary stability, ii) financial stability, iii) healthy financial institutions, and iv)fair treatment and proper protection for financial services consumers. According to Tinbergen, the first Nobel economics laureate, each objective needs specific policies. However, in fact the objectives and stabilizing policy tools are tightly related. Despite various types of central bank, on reviewing the objectives listed in Figure 1, all central banks have positive contributions at different levels to stabilizing the financial system in particular and the whole economy in general.

Figure 1: Policy Framework

The solid lines in figure 1 illustrate the primary impact and the dotted lines the secondary impact.

Source: The Role of Central Banks in Financial Stability (Schoenmaker, 2011)

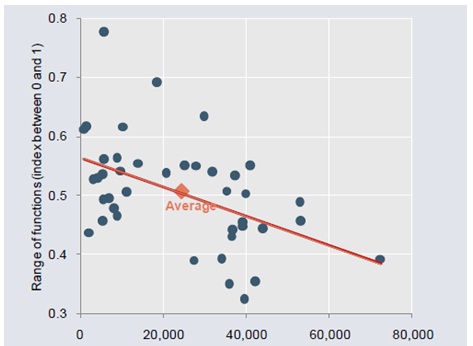

A research by BIS (2008) reveals that central banks of emerging countries have a more important role in maintaining financial stability because they have broader tasks and functions than central banks in developed countries. (Figure 2) [1]. The reason is that in underdeveloped financial systems, central banks have more resources and responsibilities in guiding the market development. This role is more limited in developed markets. In some industrialized countries, central banks are at the highest level of independence with no role in banking supervision (no department of supervision), however, central banks have its own Agency for Financial Stability or an independent agency which reports directly to the Board of Directors of the central bank on issues relating to financial stability. This reflects central banks’ serious mission of upholding financial stability.

Figure 2: Range of central bank functions and per capita GDP Information from 41 central banks

Source: BIS (2008)

2. Role of central bank in maintaining financial stability – a view from the recent global financial crisis.

According to Isarescu (2012), prior to the crisis, for a central bank, taming inflation had been almost enough for keeping a financial system stable. However, the recent financial crisis was unprecedented and governments, central banks, financial safety nets around the globe also introduced unprecedented policies for maintaining financial stability.

The abnormal, even unprecedented policies applied by many central banks during crisis time can be summarized as follows:

- Firstly, lowering interest rates to support economic recovery: this, by nature, is considered a basic tool of a central bank’s monetary policy. However, the abnormality of lowering interest was expressed in both the large range and high frequency. Interest rates in major economies were cut to almost 0 per cent, which had been previously applied in Japan only.

- Secondly, introducing quantitative easing programs: quantitative easing is an unconventional measure which is chosen when other conventional measures are not effective. Through this policy, central banks buy a large amount of assets from commercial banks and other institutions, thus, increase money supply to the economy. During the recent crisis, many central banks have bought in long-term financial assets after short-term assets buying seemed useless. It is noted that quantitative easing makes a central bank’s balance sheet bigger.

- Thirdly, implementing other qualitative easing programs: unlike quantitative easing, qualitative easing does not increase the balance sheet size but central banks change their financial asset portfolio into a pool of less liquid and more risky assets. The root of this measure is that during crisis time, just very few investors were interested in and afforded risky assets. That fact required central banks to create a flow for money channels. [2]

Besides those measures, central banks also put into practice other unconventional ones depending on specific national conditions. In short, during the crisis, central banks in many countries actively changed their focus from keeping price stability into preventing economic downturn. This change was essential in context of eroded confidence, contracted economy and frozen liquidity. In cooperation with other financial safety net members, central banks in the world have made their substantial contribution to restoring financial stability and preventing economic recession.

3. Deposit insurers with the role in supporting and contributing to financial stability

Financial systems have remarkably developed with the notable trend of multi-sector (the intermingling of banking, stocks and insurance) and multi-nation. Therefore, the objective of stabilizing the whole financial system can hardly be attained by efforts of an individual institution. In a fully developed financial system, relevant agencies which are in charge of regulation, supervision and conduct of public policy should work together as a unity in the coordination mechanism of the national financial safety net. Normally, financial safety net players are central bank, ministry of finance, supervisory agency (independent or under central bank), and deposit insurer.

The primary objective of a deposit insurer is to contribute to the stability of financial system and protect depositors who have little knowledge of finance in case of bank failures (IADI, 2006). Countries under specific economic and banking conditions have developed their own deposit insurance scheme. In general, FSB (2012) states that there are 4 basic models of deposit insurance:

- Pay-box: the deposit insurer has limited functions and the main responsibility is to reimburse insured depositors after a bank fails.

- Pay-box with extended powers: the deposit insurer has some additional tasks, such as bank failure resolution.

- Loss-minimizer: the deposit insurer actively takes part in selecting methods for dealing with bank failures to ensure the least-cost principle.

- Risk-minimizer: the deposit insurer has comprehensive functions related to minimizing overall risks including bank resolution and prudential supervision.

The deposit insurance system has not been designed to deal with overall risks of the national financial system (Sabourin, 2004) but actively take part in upholding financial stability. The first primary objective of the deposit insurance regime to contribute to financial stability is the maintenance of depositors’ confidence. The public confidence is maintained by the deposit insurer with deposit insurance coverage limit and deposit insurance policy dissemination. By that way, depositors are protected and more confident so that they feel assured putting their money into official banking system [3]. Besides, depending on applied deposit insurance models, the deposit insurer may be equipped with powers of bank resolution and/or supervision which may generate additional choices for the government and state management agencies in keeping financial stability.

For the sake of portraying the role of the deposit insurer in maintaining financial stability, two cases of the Philippines and Malaysia are studied and summarized. The two countries are to some extent at the same level of development as Vietnam and have gained positive achievements in using deposit insurance policy to support the central bank and other relevant agencies to ensure financial safety. (Figure 3)

Figure 3. Experience of PDIC and PIDM in contributing to financial stability

|

|

|

During the recent financial crisis, central banks around the world have taken both conventional and unprecedented measures to uphold financial stability. The crisis was considered a good chance for policy makers to design a better mechanism for ensuring financial safety and to confirm a bigger role of central banks in preventing crisis and stabilizing the economy. Moreover, it is essential to build an effective, appropriate and specific deposit insurance system on national conditions. Deposit insurance scheme serves as a “saving” (deposit insurance fund is contributed by member banks) which should be used in case of difficulties, the government then has more choices to protect depositors and take special control measures to avoid using state budget.

Dr. Nguyễn Văn Thạnh – Chairman of DIV’s Board of Directors

(Paper for the seminar “Role of the State Bank of Vietnam in the stability of the financial sector” held by SBV, 30 May 2014)

REFERENCE

1. BIS (2009). Issues in the Governance of Central Banks. Report of Central Bank Governance Group.

2. FSB (2010). Update on Unwinding Temporary Deposit Insurance Arrangements. Reports of the IADI and IMF to the Financial Stability Board.

3. IADI (2006). General Guidance to Promote Effective Interrelationships among Financial Safety Net Participants.

4. Isarescu, M. (2012). Post-crisis monetary policy: re-arrangement of objectives and tools. AndreiȘaguna University

5. Malaysia Deposit Insurance Corporation – Deposit Insurance Handbook

6. Phillippines Deposit Insurance Corporation Profile

7. Preda, G. (2014). Considering Regarding Unconventional Monetary Policies of Central Banks during the Present Financial Crisis. Internal Auditing and Risk Management.

8. Schoenmaker, D. (2011). The Role of Central Banks in Financial Stability. Encyclopedia of Financial Globalization.

[1] Interpretation: The development level of a nation (horizontal axis) expressed by per capita GDP; Functions of central banks (vertical axis) ranging from 0 to 1, in which 0 describes the least functions.

[2] Explained by Financial Times

[3]. FSB (2010), 48 countries and territories made adjustments of deposit insurance coverage limit during recent crisis.