Regulations on special loan operations

On July 6, 2021, the SBV issued Circular 08/2021/TT-NHNN on special lending to CIs under special control, replacing by Circular 01/2018/TT-NHNN. Afterwards, in 2022, the SBV made two further amendments to special lending activity, which were Circular No. 02/2022/TT-NHNN dated March 31, 2022 and Circular No. 13/2022/TT-NHNN October 28, 2022. The amended and supplemented contents include provisions on: special lending principles; special loan term; collateral property; order of the SBV, DIV, the Cooperative Bank and CIs in special lending and special loan extentions. Among these changes, it is worth noting that the addition of collateral for special loans will be considered and decided by the SBV.

Accordingly, the borrower must use collateral as prescribed in Clause 1, Article 12 of Circular 08, specifically, the borrower must use collateral in the following order of priority:

Mortgage: State Bank bills, Government bonds (including: Treasury bills, Treasury bonds, Central construction works bonds, National construction bonds, Government bonds issued by the Vietnam Development Bank, formerly the Development Assistance Fund designated for issue by the Prime Minister), bonds that are guaranteed to be paid for 100% of both principal and interest on maturity, local authority bonds on the list of valuable papers used in transactions of the SBV;

Mortage bonds issued by commercial banks in which more than 50% of charter capital is owned by the State (except for commercial banks which have been compulsorily purchased);

Mortgage bonds issued by CIs not under special control (except for commercial banks specified at point b of this clause) and other enterprises.

Moreover, the borrower may use the following assets as mortgage for special loans and special loan extensions as prescribed in Clause 6, Article 12 of Circular 08: Mortgage of debt collection rights arising from the borrower's credit lending to customers (except Cis); Mortgage of property rights which is the receivable interest arising from the credit lending of the borrower to customers (except Cis).

The value of the mortgage property is determined according to the provisions of Clause 2, Article 12 of Circular 08. Accordingly, the value of the collateral specified in Clauses 1 and 6 of this Article is determined according to Appendix IV promulgated together with this Circular;

The converted value of each mortgage asset for a special loan is determined by the following formula:

In which, TS is the converted value of each mortgage asset; GT is the value of each mortgage asset determined according to Appendix IV issued with this Circular; TL is the collateral conversion ratio corresponding to each collateral.

The collateral conversion ratio (TL) is determined as follows: For valuable papers specified at point a, clause 1 of this Article, TL is equal to the minimum ratio between the value of valuable papers and the amount for loans secured by mortgage of valuable papers of the SBV to CIs in accordance with regulations of the SBV from time to time; For collateral specified at Points b, c, Clause 1 and 6 of this Article, the TL value is 120%;

At the time of requesting a special loan or extending a special loan, the CI must ensure that the total converted value of the qualified mortgage assets is not lower than the amount of the special loan request or special loan extension request.

In addition to the type of collateral and the method of determining the value of the collateral, Circular 08 also stipulates the conditions for assets used as mortgage for special loans decided by the SBV. Specifically, valuable papers specified at Points a and b, Clause 1, Article 12 of this Circular must fully satisfy the following conditions: Issued in Vietnam dong; Being deposited in the SBV, including directly deposited at the SBV or deposited at the SBV's customer accounts at the Vietnam Securities Depository; Being not a valuable paper issued by the borrower; The remaining term of the valuable papers must be longer than the term of the special loan.

The bonds specified at Point c, Clause 1, Article 12 of this Circular must fully satisfy the following conditions: The conditions specified in Clause 1 of this Article; Being listed in accordance with the law; Having mortgage assets and the value of mortgage assets according to the internal assessment of the credit institution at the closest time to the time of application submission for special loan, application for special loan extension or the time of transferring the refinancing loan into a special loan or the time of evaluating the mortgage assets according to the internal regulations of the CI during the special loan period not lower than the bond's par value.

The credit grant in Clause 6, Article 12 of this Circular is being secured by property.

The DIV adjusts special lending activity

Since the Circular 08 and other amended and supplemented documents were issued, the DIV's Board of Directors issued Decision No. 858/QD-BHTG dated December 28, 2022 on special lending regulations for CIs under special control, replacing Decision No. 593/QD-BHTG dated September 7, 2018. Accordingly, the DIV conducts special lending to CIs under special control in the following three cases:

Special loans granted to support CIs’s liquidity when these CIs are near the state of insolvency or being insolvent, which could threaten the stability of the system during the time these CIs are under special control, including CI is even in the process of restructuring or the transfer plan has been approved.

Special loans granted under the decision of the SBV with preferential interest rates down to 0% to support liquidity for financial companies, people's credit funds (PCFs), microfinance institutions from the DI reserve fund when these financial companies, PCFs, microfinance institutions are at risk of insolvency or being insolvent, which threatens the stability of the system before the restructuring plan is approved.

Special loans granted with preferential interest rates down to 0% to support recovery for financial companies, PCFs, microfinance institutions from the DI reserve fund according to the approved recovery plan.

The DIV’s lending principle is to strictly comply with the provisions of the law on special lending, without affecting the reimbursement capacity to depositors, and to ensure the principle of capital preservation and development.

In the case DIV decides to grant special loan to support liquidity, the DIV stipulates that the borrower shall use the collateral in the order of priority as follows:

Mortgage: State Bank bills, Government bonds (including: Treasury bills, Treasury bonds, Central construction works bonds, National construction bonds, Government bonds issued by the Vietnam Development Bank, formerly the Development Assistance Fund designated for issue by the Prime Minister), bonds that are guaranteed to be paid for 100% of both principal and interest on maturity, local authority bonds on the list of valuable papers used in transactions of the SBV;

Mortage bonds issued by commercial banks in which more than 50% of charter capital is owned by the State (except for commercial banks which have been compulsorily purchased);

Mortgage bonds issued by CIs not under special control and other enterprises.

Mortgage debt collection rights arising from the borrower's lending to customers (except CIs).

Borrowers are only allowed to use special loans from the DIV to pay the insured depositors with the payment of both principal and interest up to the DI limit. The amount of a special loan by DIV to support liquidity must not exceed the total amount of deposits within the DI limit expected to be paid to insured depositors with a deposit balance at a CI under special control in accordance with the law. The special loan's interest rate agreed upon between the DIV and the CI under special control is determined on the basis of the refinancing interest rate announced by the SBV from time to time at the time the special loan is disbursed. The maximum loan term shall not exceed 12 months and not exceed the remaining special control period specified in the decision on special control or the decision on extension of special control which is still valid. When there is a special lending need to support liquidity, the CIs under special control is required to send a request to the DIV. The DIV will consider and decide on special lending to these CIs.

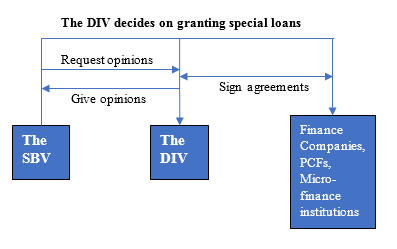

For the case when the DIV grants a special loan under the decision of the SBV, Circular 08 supplements the regulation that the SBV collects the opinions of the DIV in case the Banking Supervision Agency proposes the DIV to grant the special loan. Decision No. 858 has added this content to the process which the DIV grants special loans following the decision of the SBV and regulations on collateral for special loans in order to comply with the provisions of law. The DIV's regulations on collateral, loan interest rates, loan usage purposes, loan term, etc., comply with the provisions of Circular 08 on special loans, which are considered and decided by the SBV.

The DIV's process for granting special loans according to the decision of the SBV

In the event that the DIV grants a special loan under the recovery plan, the DIV will follow the approved recovery plan. Therefore, it is necessary to fully stipulate the contents of a special loan, such as the purpose of the loan, the loan interest rate, the collateral for the loan, the loan term, the disbursement conditions, etc., so that the DIV has a basis for implementation when the situation arises.

Suggestions and recommendations

Depending on each specific case for loan granting, the DIV's regulations on loan objects, lending purposes, loan collateral, etc., are different. However, in order to contribute to the successful implementation of the special lending activity, here are some suggestions:

Continuing to promote and utilize the role of the DIV branches with the responsibility of being the direct monitoring units that manages the local insured institutions to have timely, accurate and valuable information when considering special lending decisions.

The special lending process needs to be uniformly implemented throughout the system and be able to control arising risks in implementation, and should be carefully considered from the stage of receiving documents to making the special loan decision. The contents related to the appraisal of documents, the determination of the value of the collateral, the usage purpose of the loan, the signing of the contract, the procedure to secure the loan, etc., should be specified and ensured in accordance with the provisions of the law.

Continuing to improve the DIV's financial capacity to ensure sufficient resources and readiness to grant special loans to CIs under special control when the situation arises, especially for commercial banks as borrowers.

DIV personnel need to be continuously trained, updated and equipped with knowledge on special lending operations, especially the knowledge of loan application appraisal and collateral analysis and evaluation.

Special lending activities are especially risky because the borrowers are weak CIs under special control, so it is necessary to have an appropriate risk handling mechanism when considering granting special loans.

Department of Research and International Cooperation